Costa del sol Market: 2019-2021

Latest Posts

1. THE MARKET: 2019-2021

Due to recent events, one must take into account 2021, 2020 and 2019 together to identify any trends in the local real estate sector.

At the end of 2019 the Costa del Sol property sector already showed signs of slowing down after years of steady growth since 2013.

Although 2019 was another record year for tourism in the region, the uncertainties surrounding Brexit, in particular, appeared to impact the market as enquiries decreased during the summer and only rallied again towards the end of the year, and continued during the first couple of months of 2020.

The new year started better than many expected, and this was partly due to a revival of enquiries from the British market once Brexit became a fait accompli.

Aside from the UK, demand came mainly from Scandinavian, Belgium, Dutch, French and Middle Eastern buyers but there was also a revival of interest from Russia, while new markets such as Poland, Turkey and USA were beginning to make their presence felt, albeit in small numbers.

1.1 PANDEMIC

From the first lockdown in Spain in March 2020 there was almost no real estate activity in our core areas of Marbella, Benahavis and Estepona. The market enjoyed a small mini-boom and started moving again in July after some restrictions were relaxed, but this was short-lived as a second lockdown was imposed by the Spanish government sooner than many expected.

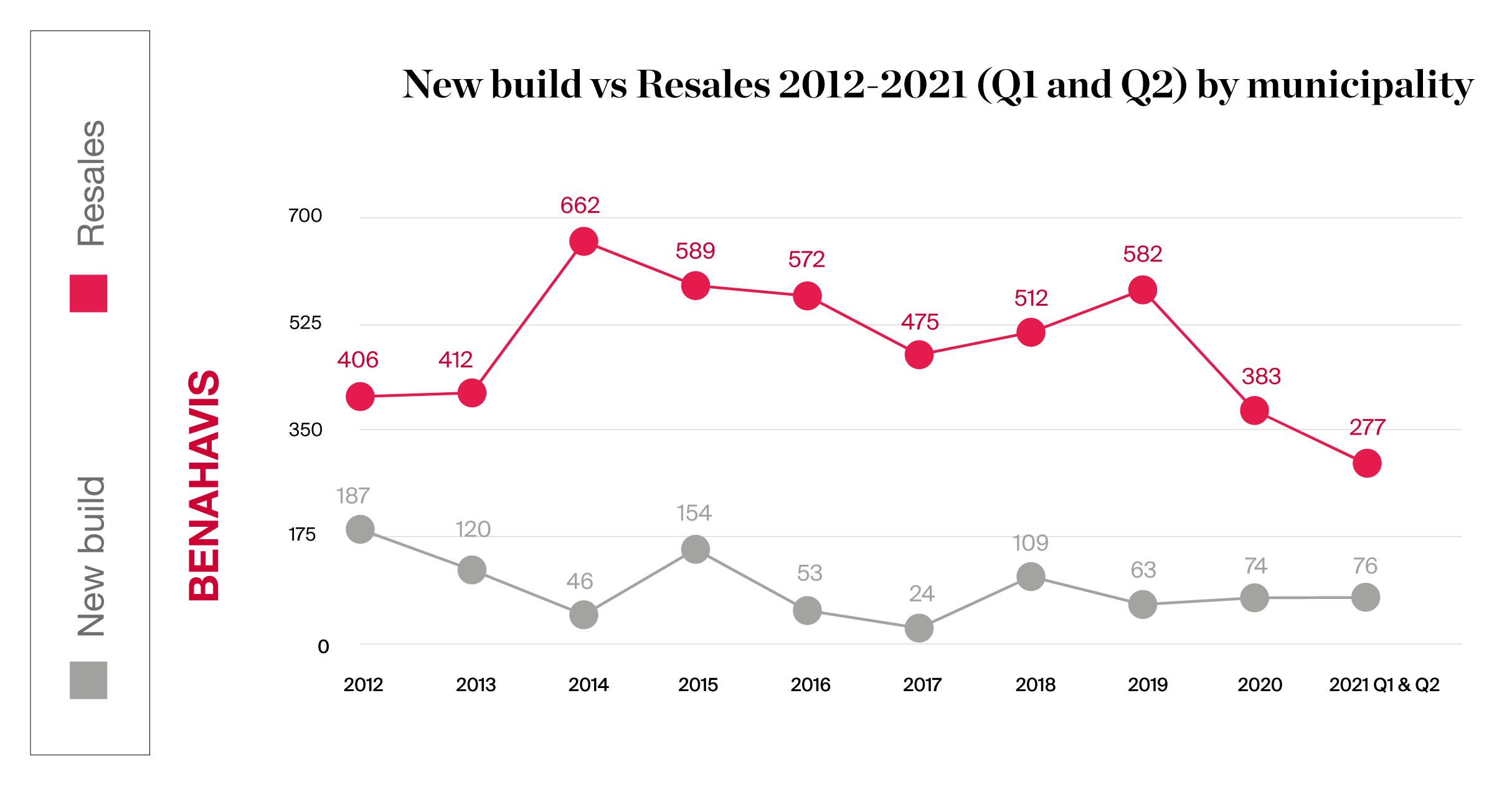

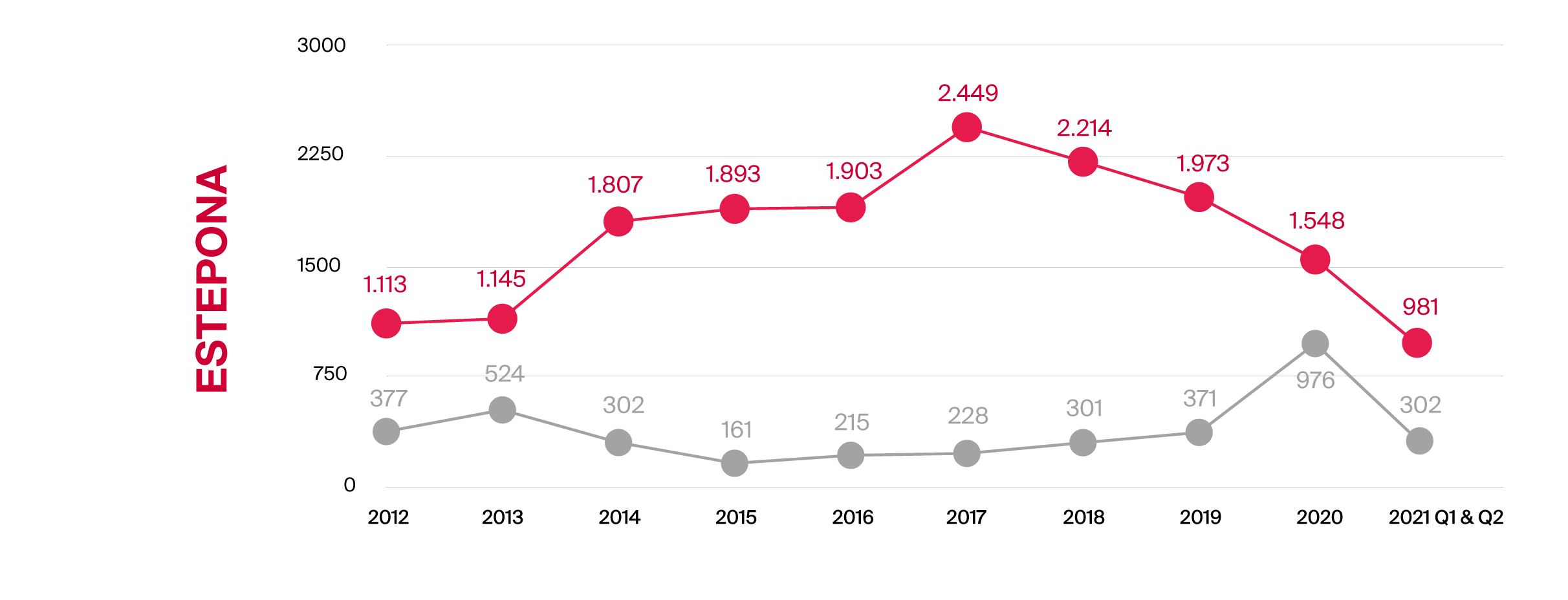

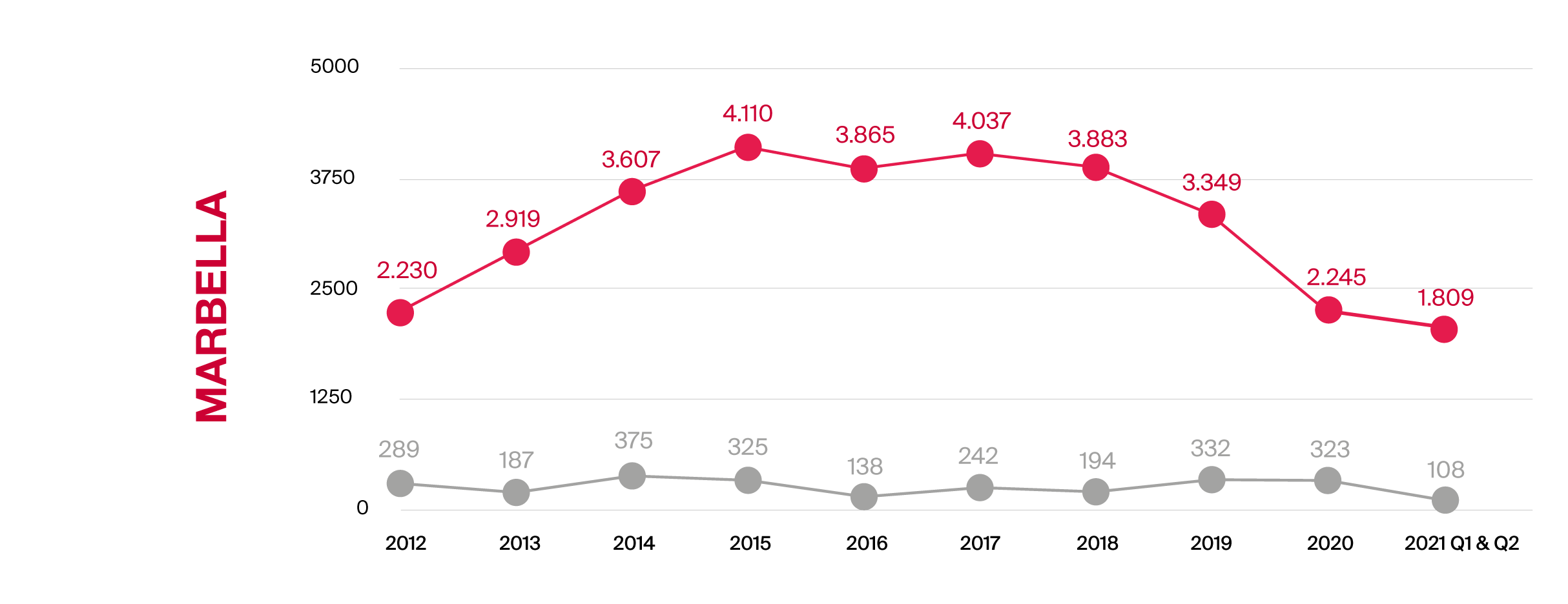

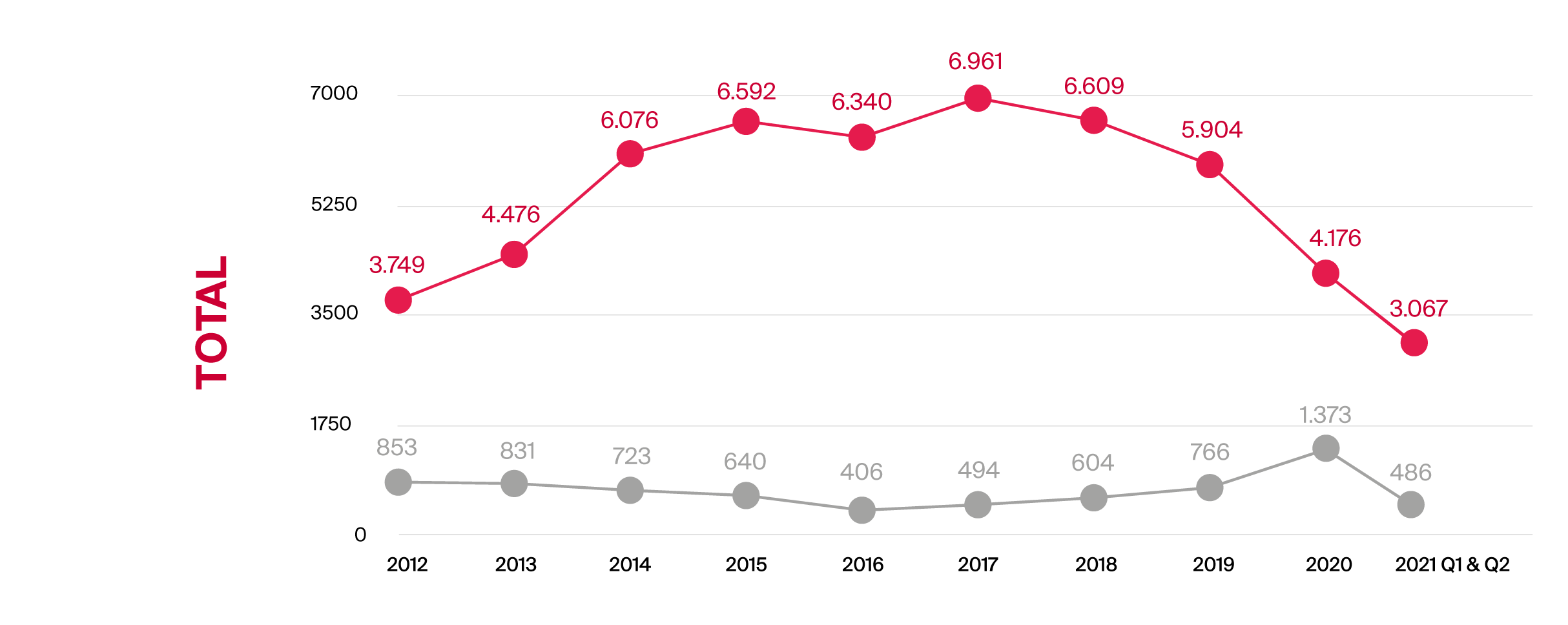

See the chart below showing property transactions 2019, 2020 and the first two quarters of 2021 for the municipalities in “The Golden Triangle” (Marbella, Estepona and Benahavis). The overall sales drop in Marbella and Benahavis in 2020 vs 2019 was 30.24% and 29.15% respectively. In Estepona the drop was only 7.68% due to the sale of new builds which increased 163.07%. This was also noted in other municipalities but not to the same extent and less so in Marbella, where new build sales dropped slightly (2.71%). (Source: Ministerio de Fomento)

There were property price adjustments in some areas. Prices fell slightly but only in specific cases: Properties that had been on the market for a very long time, those significantly overpriced, situated in the least popular areas or due to owners’ own personal circumstances. Nevertheless, there were no massive price drops, as might have been expected in a crisis scenario. Moreover, when the market started to reactivate in the summer, we experienced a wave of aggressive offers, only to be met by reluctant sellers.

As restrictions were lifted, remote property viewings via virtual tours, videos and video calls became an essential tool to help clients narrow their searches in preparation for their visit to the area. In cases where clients already knew the area and had very specific property requirements, remote viewings helped them make the decision to secure a property with a reservation, awaiting travel to complete the purchase.

During the 3rd and 4th quarters of 2020, we saw an increase of enquiries of 32% compared to the same period of 2019. In spite of travel restrictions, many more viewings took place and sales started to materialize during the 4th quarter of 2020 though in general, we observed that completion and signing of deeds took longer than usual.

1.2 2021 FIRST QUARTER

National:

According to Spain’s Ministry of Development, nationally 141,000 sales were completed in the first three months of the year, 13.1% of these were bought by foreign buyers.

Of these, 4.5% were non-resident buyers at a time when strict travel restrictions remained in place and down from only 7% in Q1 2020 prior to the pandemic.

Interestingly, some 8.6% of purchases in Q1 2021 were by foreigners already resident in Spain potentially seeking to upsize or relocate.

Malaga province:

On a provincial level, 7,208 property purchases were completed in Malaga Province during Q1/2021 which is an increase of 14.,4% compared to Q4/2020, according to data released by the National Statistics Institute (INE).

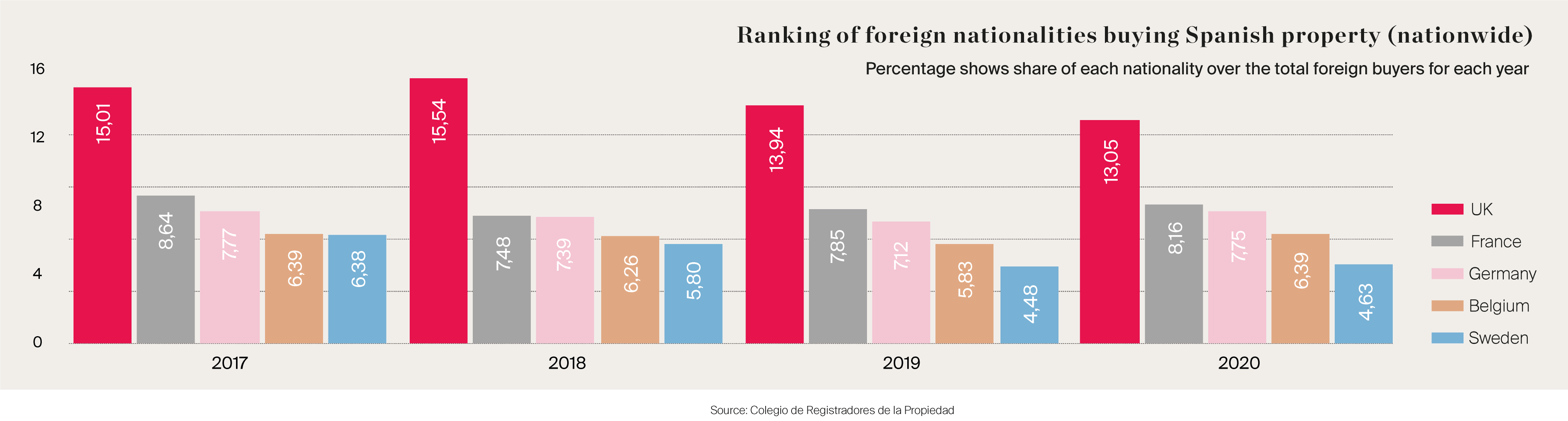

In terms of nationality, almost a third (27.53%) of all property sales during Q1 2021 in Malaga Province were to foreign buyers, almost the same as in Q1/2020 (27.76%), with the top 5 being British, Germans, French, Swedish and Belgians, in that order.

During this period, the Marbella area real estate market saw the beginning of a post-pandemic boom in the mid and particularly in the higher-end of the market, something which continues at the time of writing this report. While official figures regarding percentage of Spanish buyers vs foreign buyers in the Marbella, Benahavis and Estepona area are unavailable, we would expect figures to be significantly higher than those for Malaga province as a whole.

1.3 2021 SECOND QUARTER

There were 137,204 property transactions in Spain in Q2 this year, the highest number of property sales seen in Spain in one quarter since 2008, according to official statistics.

In Malaga province there were 7,259 property transactions in Q2, a small increase on the previous period. While the number of resales rose, with 5,576 a 7.8% rise against Q1, new build transactions stood at 1,583, which is 18.6% lower than the previous period.

FOREIGN BUYERS – SECOND QUARTER 2021

National

Fewer than 1 in 10 (9.95%) of all sales of Spanish properties in Q2 were to foreign buyers, a small (0.23%) rise against the first 3 months of 2021. In terms of nationality, the largest percentage remained British buyers, which represented 9.49% of the total, the lowest on record, and only 1% more than sales to German buyers during this period (9.04%).

For reference, in 2009 British buyers amounted to approximately 1 in 3 of all sales of properties to foreign nationals in Spain.

Andalucía

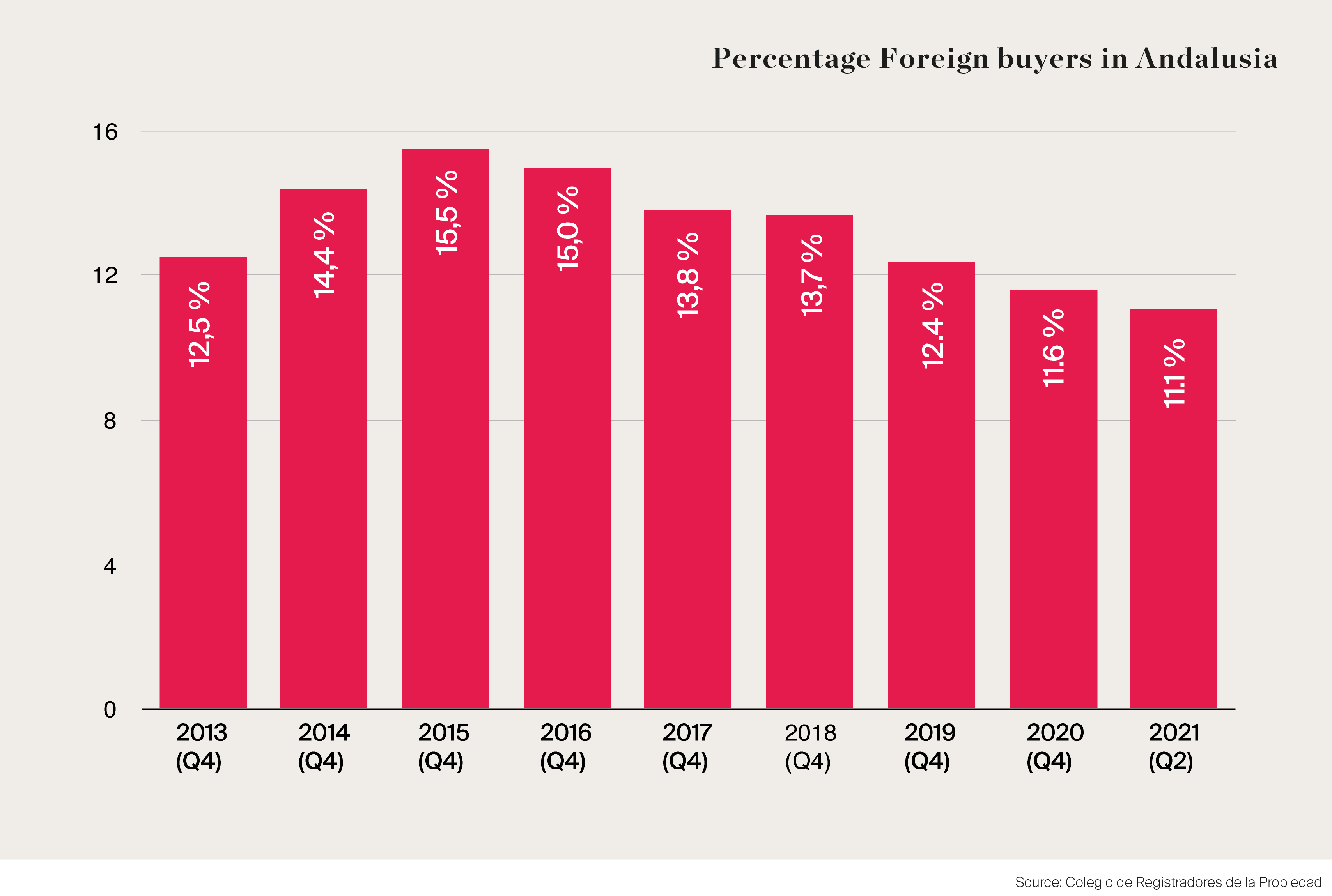

For the region of Andalucia, comparing the most recent figures for Q2 of 2021 with the 4th quarter of previous years we can see that despite the pandemic, the proportion of foreign buyers vs domestic buyers has barely changed since 2013.

Málaga Province

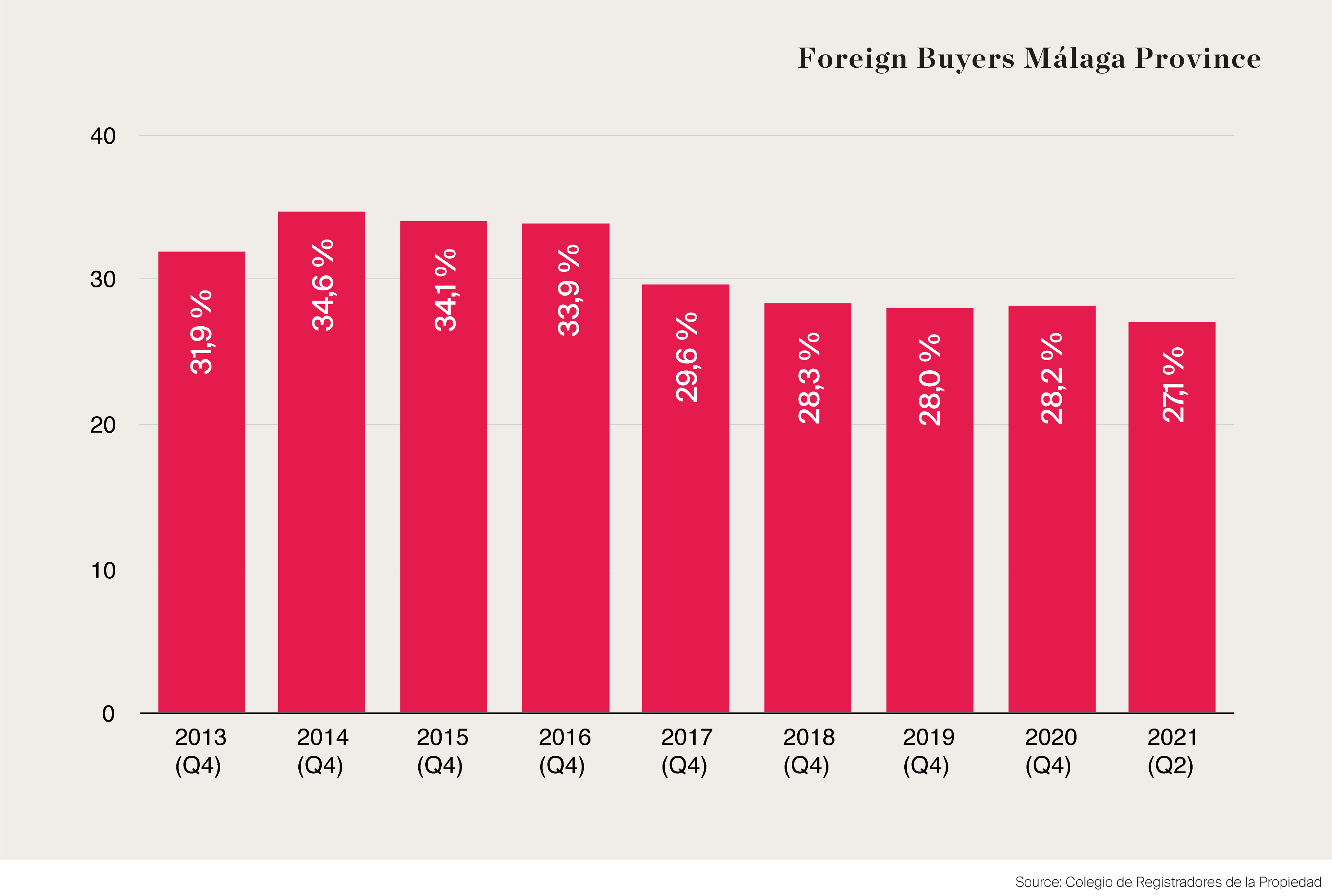

This difference is more noticeable at a provincial level for Málaga where traditionally 25-30% of buyers are foreign. However, the drop is still a relatively small change given travel restrictions from principal buyer markets such as the United Kingdom which remained in place throughout Q2 this year and the bulk of the decline coincides with the Brexit vote of June 2016.

YEAR ON YEAR COMPARISON (2015 TO Q2 2021) SPAIN, ANDALUCIA AND MALAGA

Enquiries

In terms of nationalities for client enquiries and traffic to our web, British are still the highest percentage, followed by Germans, French, Swedish, Belgians, Dutch, Irish and Swiss. Russians are discreetly coming back to the market.

We have also noticed new nationalities such as Polish and Bulgarians.

Web traffic

Comparing the traffic to our website for the first 2 quarters of 2021 vs the first 2 quarters of 2020 these are our takeaways: (For the sake of relevance, only countries with 1000+ visits are included.)

Traffic: 29% more visits in 2021 so far vs 2020 and +36% against 2019.

Nationalities: Comparing 2021 visits so far to the same period in 2019 we can observe strong performances from all the usual areas such as the UK, Scandinavia and Benelux, with a few others which stand out, namely Poland up by 171%, Czech Republic +136%, UAE + 116%, Russia +105% and Ireland +86%.

Swedish Buyers

Sweden overtook the UK as the nation with the most searches for Marbella property in Q2 this year according to figures from Spain’s largest portal Idealista. Although it should be stressed that these are purely statistics related to web traffic to the portal, they do highlight a general trend.

In the first 7 months of 2021, we saw an increase of traffic to our website from Sweden of 71% compared to the same period of 2020 and +57% against 2019.

1.4 SPANISH MORTGAGES

According to the Bank of Spain, almost €30 billion (€30,000 million) in mortgage loans were granted by Spanish banks in the first half of 2021. This represents increases of 60% & 35% against the same periods of 2020 and 2019 respectively. These are figures not seen since 2010 when the figure reached €37 billion.

1.5 BREXIT

Due to the pandemic and the lag in data availability, it is difficult to gauge the true impact of Brexit to date on British buyers.

With British second homeowners now limited to spending only 90 out of every 180-day period in the European Union, some UK residents with homes in Spain are rethinking their long-term plans.

For those with work and schooling commitments in the UK, the new rules aren’t too onerous, but for others looking to work remotely, or for retirees, the rule is leading them to consider a permanent move.

During the first half of 2021 of continued travel restrictions imposed by the British authorities with Spain being placed on the UK’s ‘Amber’ list has hampered attempts by Brits to visit Spain. On a local level, over the first 7 months of 2021, we’ve seen visits to our website from people in the UK increase against 2020 and 2019, supporting the argument that interest from British buyers remains strong.

Against all odds, British buyers remained on top as the principal non-Spanish nationality in Q2 2021 representing 9.95% of all Spanish property sales to foreign nationals, according to official data (Registradores).

2. PROPERTY TRENDS

Despite the turmoil, new opportunities are emerging as the way we live, work, exercise and interact is changing. Travel restrictions may be clipping the wings of prime buyers but with fewer people tethered to an office, this is likely to change with knock-on effects for second-home markets and investors globally.

On the Costa del Sol, the bulk of interest in luxury homes in the €2m+ range remains concentrated in the municipalities of Marbella and Benahavis, and to a lesser extent in neighbouring Estepona.

What are foreigners buying?

The majority across all nationalities buy more resale properties than new build properties. However, according to official national statistics for 2020 roughly a third of properties bought by Belgians (33%), Norwegians (32%) and Swedes (27%) are new build properties. Whereas of the traditional western and northern European foreign buyer market, the French (10%), British (15%) and the Irish (16%) buy proportionately fewer new build properties, favouring resale properties.

2.1 NUEVA ANDALUCÍA

Key areas of Marbella such as Nueva Andalucia in the so- called ‘Golf Valley’ have become very popular in the past five years. Property prices for reformed turnkey villas have reached unprecedented highs, especially those situated in a frontline golf position.

2.2 LA ZAGALETA

Although transaction volumes are low, relative to Marbella the exclusive urbanisation La Zagaleta is experiencing a record year. The 900-hectare mountain retreat in Benahavis was named an up-and-coming location according to Knight Frank’s “Next Neighbourhoods: Places to watch in 2021” report due to its natural environment, connectivity – both in terms of technology and community – as well as privacy.

Other areas in Benahavis for which we’ve seen a renewed buyer interest are the Marbella Club Golf Resort, El Madroñal, La Alqueria, Los Flamingos and El Paraiso.

2.3 NEW DEVELOPMENTS

According to a report by Sociedad de Tasación (the leading company of Chartered Surveyors), the price of new housing in Spain stood at 2,472 euros/sq metre at the end of June, the highest figure since 2010 and, shortening the gap with the maximums recorded in 2007 (2,905 euros/sq metre). In the Marbella area, developers confirm that the lower end of the market (up to 500,000 euros) suffered the most, whereas prime developments with luxury units have increased their prices and many of them have been fully sold or are left with few units, especially those on a front line beach position in Marbella and Estepona or Beachside in Marbella’s Golden Mile.

2.3.1 BEACHFRONT

Renovated apartments in the development Marina Puente Romano in Marbella’s Golden Mile have also been selling for €10,000 to €25,000 per square metre depending on position and orientation within the development. The lack of new modern beachfront properties with the addition of hotel services is in high demand and accounts for the top prices achieved in Puente Romano.

Emare (Completed)

- Location: Frontline beach, New Golden Mile, Estepona.

- Prices started from €2,360,000 – €3,975,000.

- 28 apartments.

- Delivered in 2020.

- All units sold.

Velaya (under construction)

- Location: Frontline beach, New Golden Mile, Estepona.

- Price range: €792,000 – €3,960,000.

- 30 apartments, 6 bungalows and 2 villas.

- Completion (estimated) 1Q/2022.

- 70% sold/reserved (as of September 2021 according to developer).

UNO El Ancón (planning process)

- Location: Frontline beach, Golden Mile, Marbella.

- Price range: from €8,700 to €15,000 per square metre depending on location and views, during the pre- construction phase. Prices will increase as soon as construction starts.

- There will be 58 apartments, and completion is expected by the end of 2023.

- License is just about to be granted, and there are no units available for sale, as all units are reserved (as of September 2021 according to the developer).

There is a demand for properties, especially new apartments, in the beachside Marbella-East area, which has become increasingly popular, but most developments are located in the mountainside. This area has arguably the best beaches in Marbella and clients have been buying old villas for renovation, with some of them reaching record prices for the area.

The Four Seasons Hotel and private residences project due to start soon will be an added value for the whole East- Marbella area.

2.4 BRANDED RESIDENCES AND HOTEL PROJECTS

According to Knight Frank Global Buyer’s Survey 2021, “39% of respondents would be willing to pay a premium for a branded residence. Services and amenities are the top motives behind the purchase of a branded residence.” In response to an increasing demand for branded residences in the last four of years, Marbella has become the destination for several very exciting luxury hotel and private residence projects.

A development located in the heart of Marbella’s Golden Mile called “Epic” will have two phases of branded residences by Fendi Casa.

One of the biggest and most glamorous of the hotel projects is the Las Dunas Club and its five-star W Hotel, which will form part of a leisure and residential resort by the beach between El Rosario and Los Monteros, on the east side of Marbella.

Part of the new Starwood-Marriott group, this project features a luxurious modern design. The development is scheduled for opening by the summer of 2023, and involves an investment of €200 million on 170,000m2 of land, incorporating not only the five-star deluxe hotel with 186 rooms and suites but also a beach club and 86 tourist apartments, as well as eventually private residences.

The Four Seasons group is also planning a five-star deluxe hotel in a prime beachside location of 325,000m2 in Río Real. This highly ambitious project that includes a major upgrade in local infrastructure involves an investment of €700 million for a 180-room hotel. 200 apartments and 40 villas, with a new scenic pathway connecting the main hotel area to the beach club. The Surf Club, as it will be known, also features a more ‘boutique hotel’ with 30 rooms by the sandy shoreline.

Meanwhile, the iconic Hotel Don Miguel, which covers a 125.000m2 site in Marbella, is undergoing renovation works by the Club Med Group totalling €80 million to transform it to the Club Med Magna Marbella. Due to open in the summer of 2022.

The Hilton group is also strengthening its presence in the area with a new 194-room hotel near Puerto Banús – the Conrad-branded hotel in Spain – investing €134 million in it and a brand new exhibition centre. Named the Conrad Costa del Sol Hotel, it is scheduled to be ready well before the start of the 2022 summer season.

Another large-scale project involves the €77 million Siete Revueltas Resort in the Santa Clara area just east of Marbella, where a public fluvial park and luxury resort will arise in 2022 with capital from Bahraini investors.

Between them, they will generate over 2,000 direct jobs and stimulate the local economy, as well as adding valuable modern leisure amenities to Marbella. To ensure no momentum is lost, the Andalusian regional government, together with the Marbella Town Hall, has streamlined the usually lengthy bureaucracy and is giving its full cooperation to make these important projects a priority, with all eyes trained on the 2022 and 2023 tourist seasons.

WHAT BUYERS WANT

Larger properties: Oversized apartments or Villas with multi-purpose spaces that can be adapted as needed.

Countryside homes: With large extension of land, at a short driving distance to urban centres such as those found in the areas of Ojen, Monda or Coin, or the mountainside areas of Estepona and areas around Benahavis, which put you in town within a 15min to 25min drive.

Bigger and better communal facilities and services: Larger swimming pools, gymnasiums with the latest fitness equipment, meeting rooms/co working areas and multipurpose rooms, children’s play areas and a social hub.

Sustainability certificates: (such as BREEAM) and environmentally friendly building solutions. (According to Knight Frank’s Global Buyer’s Survey 2021, 84% of buyers say the energy efficiency of a future home is important or very important to them).

Excellent internet connection

Modern designs with touches of traditional: The architectural trend is changing in favour of a combination of homes with sleek modern lines with elements of the traditional Andalusian architecture.

Branded residences and concierge services: Be it a hotel-led development with integrated or linked residences, benefiting from the hotel brand, its management and luxury services or a dedicated in-house concierge team.

3. BUYERS TRENDS

A changing demographic of international buyers.

There is a new generation of younger buyers who, about 5 years ago, were not seen buying 5+ million euro properties. Nowadays, we have seen 30-45-year-old clients with financial means to purchase high-end properties, mostly coming from entrepreneurial, IT business, cryptocurrencies and online industries.

Buyers in the 50 – 65 age bracket remain a significant percentage of overall sales of luxury homes in the Marbella area.

3.1 REMOTE SELLING AND FASTER BUYING

The increasing and unexpected number of sales that have been completed by video or virtual viewings this year are no doubt a sign of the customer’s confidence in the Marbella market.

Moreover where typically a client would take on average 12 months to purchase a property (between initial enquiry and completion), we are finding the buying process significantly shortened to anywhere from 2 months to a new average of 7 months.

3.2 REMOTE WORKING

In the Marbella area, traditionally a second home market for international buyers, the line between primary and secondary residences is becoming blurred.

For many younger entrepreneurs from Northern and Western Europe, what would have been a holiday home is now their primary residence, choosing to relocate their families to Marbella, while working remotely.

In the higher end, wealthy business owners are opting to run their companies from Marbella, commuting to the country where their operations are based as and when required. This is not new but has increased during the last few years.

WHY IS MARBELLA’S REMOTE WORKING COMMUNITY ON THE RISE?

High speed internet: Marbella is Spain’s first 5G city. In 2020, Marbella became the first Spanish city to gain 5G network coverage meaning Marbella enjoys broadband speeds 52% above the national average according to “Fair Internet Report”.

Connected to Europe and the World: Easy connections to global business hubs. Whether London, Geneva, Paris or Dubai, Malaga Airport offers easy access to over 133 locations globally.

Property choice: The quality and offer of properties in Marbella, with specs and finishes coming a very long way in recent years, make homes in our region comparable to those in most tier-one cities. US, French and German REITS are turning their attention to the region, further evidence of the market’s maturity and growth potential.

World-class education: (Excellent international schools. Marbella and the wider area offers 15 international schools, several offering the British curriculum or International Baccalaureate, plus German, Swedish, Norwegian and Finnish schools as well as an École Française Internationale and a Lycée Français.

Language: Being an international resort, there is no shortage of amenities and services for foreigners who do not speak Spanish. The common non-Spanish language here is English, and there is no shortage of services to cater for other nationalities.

Climate and lifestyle: It’s no secret that Marbella enjoys an extremely favourable climate. For those professionals who can now work from anywhere in the world, many are prioritising health and wellness, seeking proximity to golf courses, tennis academies, marinas and spas, all on tap in Marbella.

4.1 GLOBAL MACRO OUTLOOK

The economic recovery will continue.

The IMF left its forecast for global GDP growth at 6% for 2021. Prospects for emerging and developing economies were downgraded, this move was balanced by upgrades for advanced economies, with the UK and US leading with 7% growth in 2021.

Inflation concerns are waning, for now

With indications that growth in some economies, including China, is decelerating, inflation concerns have started to subside. Reduced demand for commodities is expected to feed through to lower price pressure. OPECs decision to increase oil supply is providing an additional relief on prices.

Rates remain low

Central banks are continuing to view inflation as transitory with the Federal Reserve’s latest guidance indicating two small rate rises in 2023 and the ECB stating they will pursue a “persistently accommodative” stance – meaning rates will remain low for the foreseeable. The prospect of action by the Federal Reserve, combined with strong growth will continue to support a strong US dollar.

Climate emergency

With the United Nations Climate Change Conference, COP26, taking place in November this year, governments and central banks are increasingly turning attention towards driving net zero initiatives. This focus will continue to drive regulation and investment.

4.2 GLOBAL RESIDENTIAL MARKETS

House price surge continues but it isn’t global.

National and city-based house price indices are surging but it’s a story largely confined to advanced economies where the pandemic has sparked a reassessment of housing need, where government action has protected mortgages and jobs, and where households have accrued significant savings.

We don’t expect a price bust

Compared to 2008, banks now operate under tighter lending rules, households are less indebted, the tapering of fiscal stimulus measures is not expected to bring about a sudden jump in unemployment, the prospect of sudden hikes in interest rates is unlikely, and governments are taking a much more interventionist stance to deter speculative activity. But, perhaps the most critical issue supporting prices is the extent to which many markets continue to suffer from an undersupply of housing.

Travel bans will impinge on cross-border transactions in 2021

With many travel bans likely to remain in place until 2022, cross-border transactions by prime purchasers will be hampered. Countries with advanced vaccine programmes, the US, UK, Canada and UAE may as a result become influential drivers of prime markets in the second half of 2021.

KEY FINDINGS

A booming luxury market: The Marbella real estate market has certainly recovered from the pandemic and is showing an unprecedented number of transactions in the prime/luxury market. How sustainable this situation is in the medium/ long term will depend on the ongoing ease of lockdowns across different countries, the success of vaccination policies as well as financial recovery and tax reliefs. Property transactions in Spain in Q2 of 2021 were up 79.2% on the same period last year and represented the highest volume of transactions since 2008, according to official figures (Registradores).

Shortage of properties in key areas: If demand continues at current levels, there will be a shortage of properties in prime areas such as the frontline beach along the Golden Mile, Sierra Blanca, Los Monteros or Cascada de Camojan. Additionally, newly built or modernized properties with the latest high-tech amenities and views in the Marbella municipality and in specific residential areas such as Zagaleta or El Madroñal are starting to become sparse.

The Branded Residences boom: With some of the major international hotel brands making an appearance in Marbella such as the Four Seasons, W Hotel, Club Med, Hilton or the Siete Revueltas Resort, some of them offering private residences, the area is set to become even more of an international destination and shows proof of a growing confidence in Marbella as a luxury property and lifestyle safe-haven.

A changing buyer: Younger, choosing a property faster, and in need of more space, high speed internet connection, concierge services, wellness and wellbeing amenities and sustainable designs.

Remote worker’s paradise and relocation destination: Chosen by an increasing number of foreigners due to its climate, lifestyle, ease of access to major European cities and a total of 133 destinations from Malaga Airport, and high-speed train connections to major Spanish cities, its variety of international world-class schooling and education, and choice of property. Malaga city has become a technology hub, with many companies setting up their offices right outside the city (including Google’s centre for Cyber Security due to open in Q1 of 2023).

Purchase tax reduction driving increased property purchases: In late April of 2021 the Andalusian regional government announced a reduction of transfer taxes for resale property purchases in Andalucia from 8-10% to a flat rate of 7% for second-hand property purchases. For new build properties, stamp duty was reduced from 1.5% to 1.2%. %. This was initially approved as a temporary reduction until the end of 2021 and has accelerated property purchases to be completed this year. For this reason, at the end of October the Andalusian government decided to extend it indefinitely.